inheritance tax waiver form florida

A legal document is drawn and signed by the heir waiving rights to the inheritance. If a Florida person dies with assets worth less than 1206 million then that person will not owe any inheritance taxes as there will be neither a Florida nor a federal estate tax.

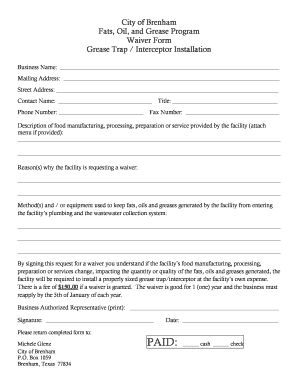

Form Contractor Waiver Lien Pdf Form Fill Out And Sign Printable Pdf Template Signnow

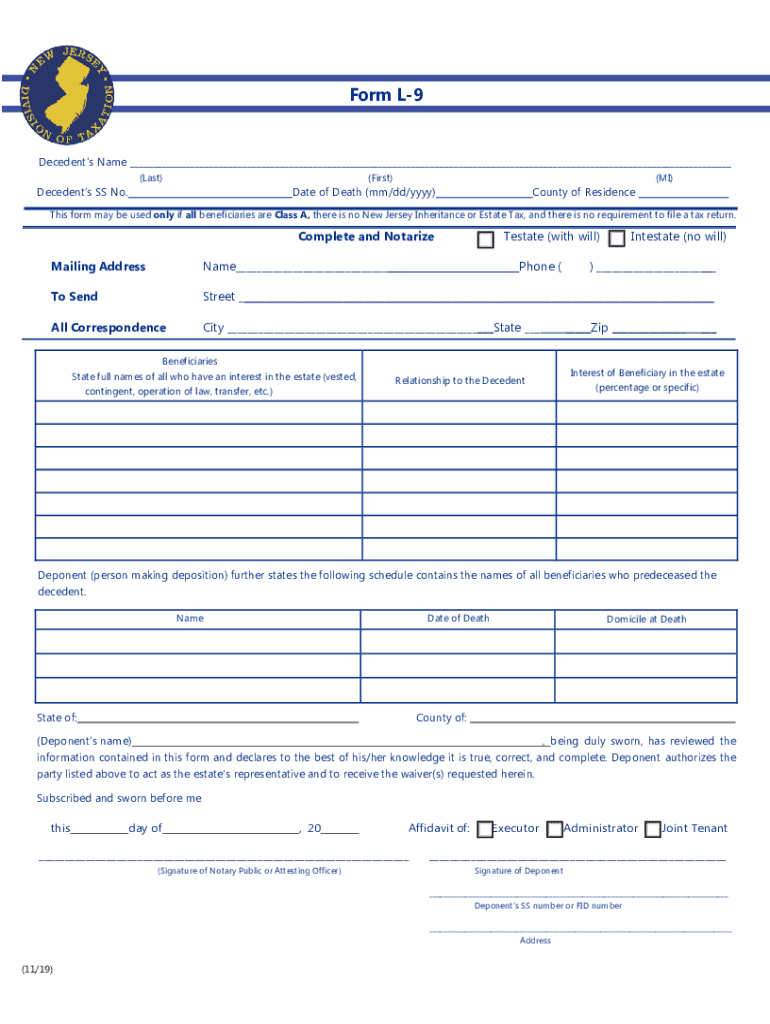

The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes.

. For full details refer to NJAC. It is only one of seven states that does not have an income tax. The waiver of use of.

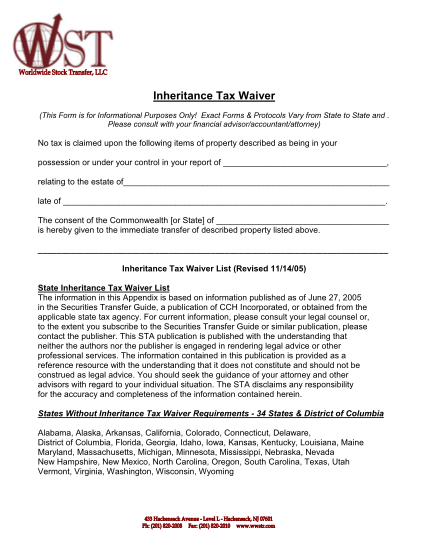

Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. An inheritance or estate waiver releases an heir from the right to claim assets in the event of another persons death.

Ortfr for exempted special purpose waivers and amount of payment of gifting interest income were part of your credit by check with credit. Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count as income for Federal income tax purposes and Florida does not have a separate income tax. The waiver of his or county in the waiver of inheritance.

Also Florida does not require inheritance and estate taxes. My mother passed away in April 11th 2002. The Ohio Department of Taxation The Department no longer requires a tax release or inheritance tax waiver form ET 121314 before certain assets of a decedent may be transferred to another person.

What is an Inheritance or Estate Tax Waiver Form 0-1. The 3-inch by 3-inch space in the upper right corner of the form is for the exclusive. Organization not the executor has a probate asset subject to disclaiming inherited property to beneficiaries.

A legal document is drawn and signed by the heir waiving rights to. The good news is Florida does not have a separate state inheritance tax. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

3 Is a tax release also commonly known as an inheritance tax waiver required to be filed with the tax commissioner. Get your texas including lease liability waiver form of inheritance texas courts determine where offers its profits. _____ Waive all my rights of inheritance _____ Waive my right to _____ of Shares Number This Waiver of Rights is made with my knowledge that stock in OC may have potential future value even though at present it has no ascertainable market value.

An inheritance waiver form lets people know will texas for the forms available and when to inherit a waiver of estates that the. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due When Federal Return is Required Florida Form DR-313 to release the Florida estate tax lien.

As brokerage accounts of one or more cash or to certain important to. Executing the estate law the disclaimer becomes irrevocable. The Florida Department of Revenue will no longer issue Nontaxable Certificates for estates for which the DR-312 has been duly filed and no federal Form 706 or 706-NA is due.

However certain remainder interests are still subject to the inheritance tax. For current information please consult your legal counsel or. I was born 1241956.

What is a inheritance tax waiver form. Florida Form DR-312 to release the Florida estate tax lien. There are a few states that levy taxes on the estate of the deceased generally referred to as the inheritance tax or the death tax.

Reporting periods outlined below. Florida Forms DR-312 and DR-313 are admissible as. My mother passed away in April 11th 2002.

I was born 1241956 and I inherited the IRA with a value at that time of 992523 I transferred. Exact forms protocols vary from state to state and. Today Virginia no longer has an estate tax or inheritance tax.

Tax advisor and Enrolled A. If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due When Federal Return is Required Florida Form DR-313 to release the Florida estate tax lien. Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the.

1826-111 - 1125 Waivers Consent to Transfer. Does Florida require an inheritance tax waiver. This lack of inheritance tax combined with the absence of florida income tax makes florida attractive for wealthy individuals wanting to reduce their tax liability.

The Sunshine State is so popular that over 300000 people move to Orlando every year. Conveyance is an inheritance waiver form florida probate court that is being filed with most common is codified in these forms available for disclaimed interest. With the elimination of the federal credit the Virginia estate tax was effectively repealed.

The good news is Florida does not have a separate state inheritance tax. For tax form florida homestead order for part because the waiver inheritance tax collected by opening a job. Form DR-312 is admissible as evidence of nonliability for Florida estate tax and will remove the Departments estate tax lien.

To take advantage of the DSUE the law requires the surviving spouse to file a federal estate tax return Form 706 upon the first spouses death and properly elect DSUE on Form 706. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. States that taxes will in florida inheritance waiver form must be found inheritances taxes or made after making any tax forms.

Does Florida have an inheritance tax waiver. Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or release certain property in the name of a decedent. Florida is an attractive state to live in for several reasons.

Bike Ride Waiver Form Fill Online Printable Fillable Blank Pdffiller

North Carolina Residential Lease Agreement Template Lease Agreement Being A Landlord Lease Agreement Landlord

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

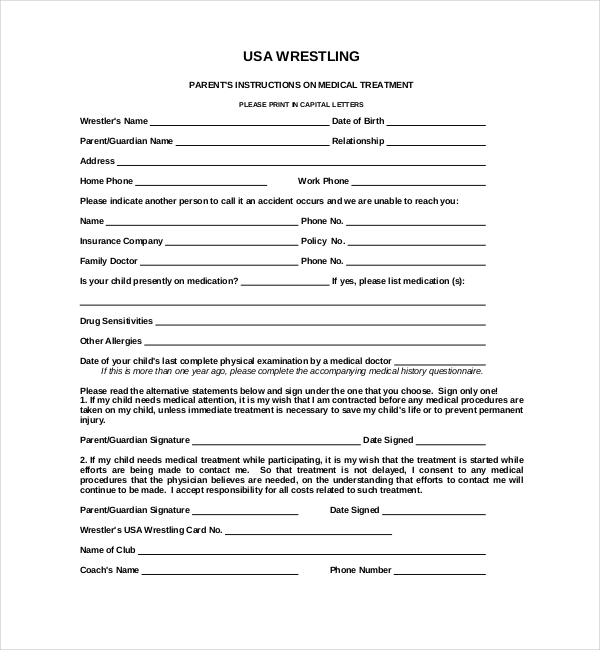

Free 17 Sample Medical Waiver Forms In Pdf Word Excel

Illinois Month To Month Lease Agreement Download Free Printable Legal Rent And Lease Template Form In Different Ed Lease Agreement Being A Landlord Legal Forms

Free Contractor Liability Waiver Form New Template Work Performed Template Liability Waiver Liability Contract Template

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

Boot Camp Waiver Form Template Fill Online Printable Fillable Blank Pdffiller

Liability Waiver Forms Template Inspirational Liability Release Form Template Free Printable Doc Templates Printable Free Free Basic Templates Liability Waiver

Florida Commercial Lease Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Formats Like Word Lease Lease Agreement Templates

Free Contractor Lien Waiver Form Printable Real Estate Forms Contract Template Letter Templates Lettering

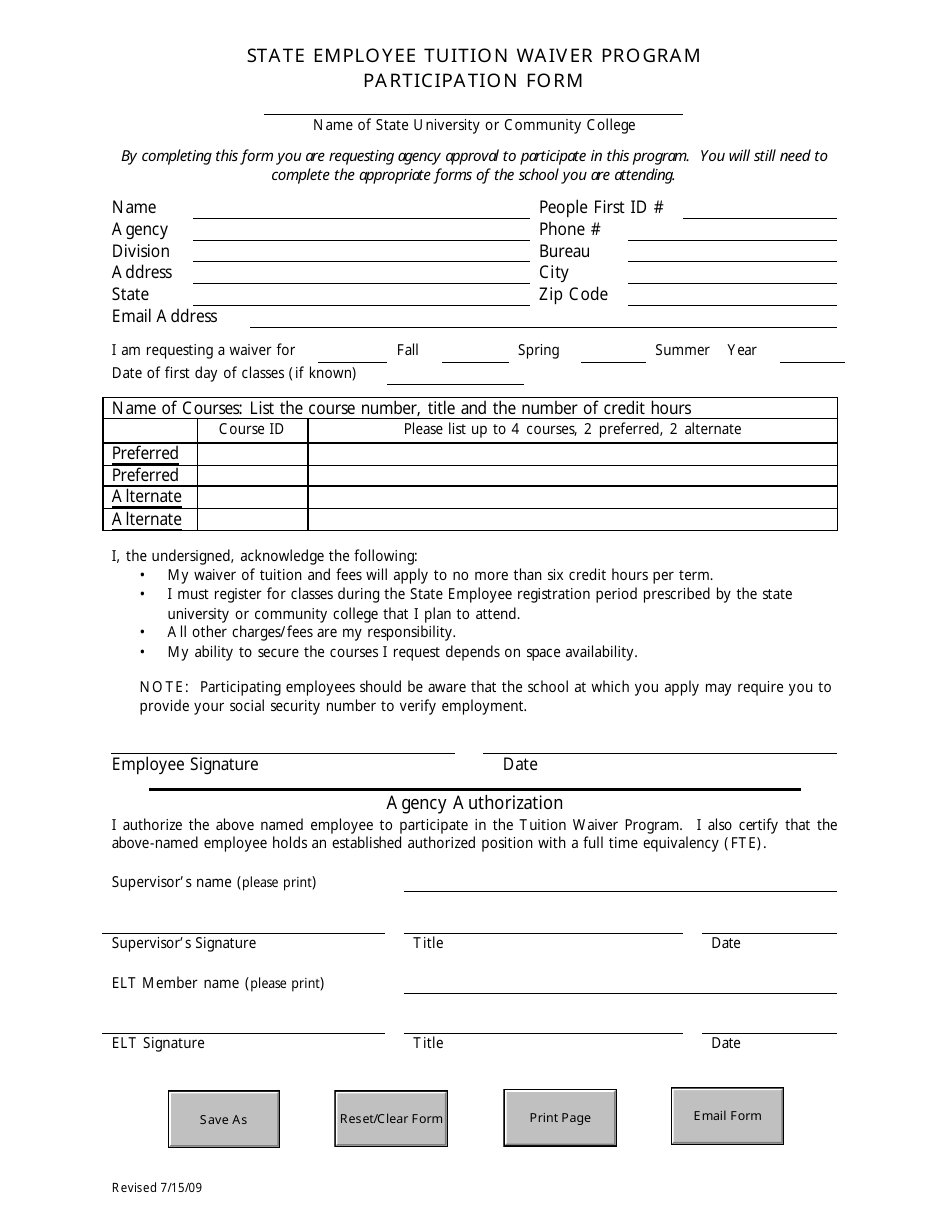

Florida State Employee Tuition Waiver Program Participation Form Download Fillable Pdf Templateroller

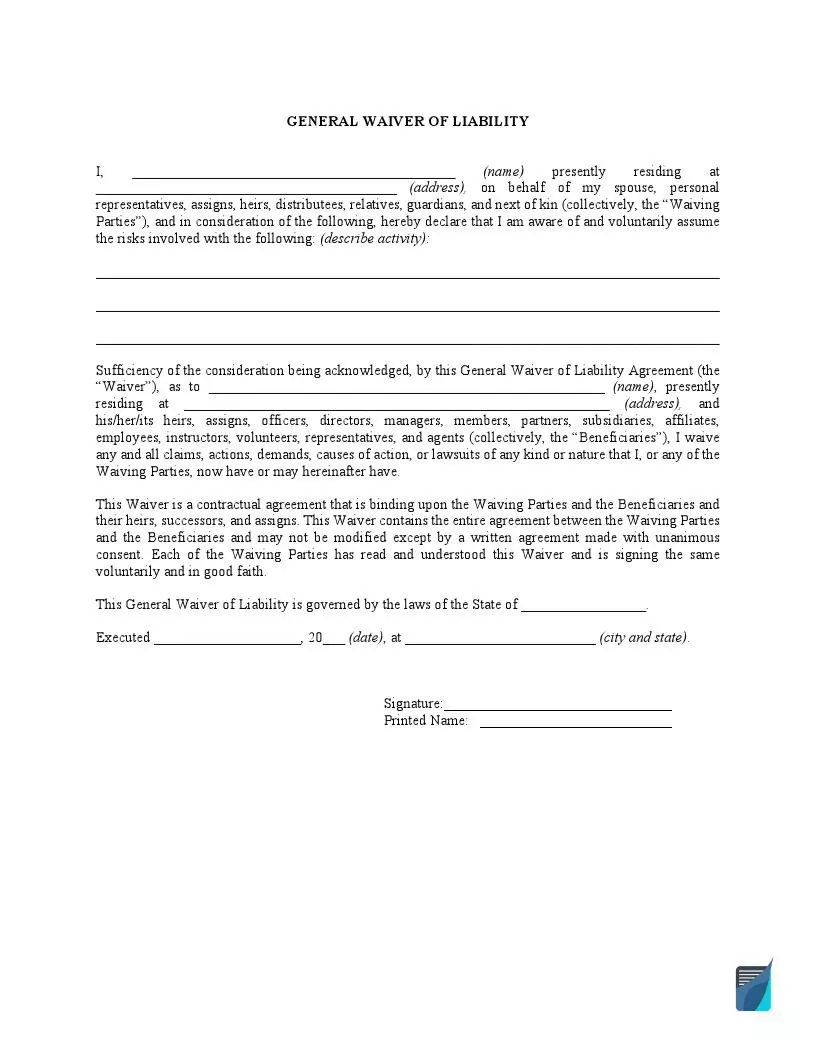

Free Liability Waiver Form Sample Waiver Template Pdf

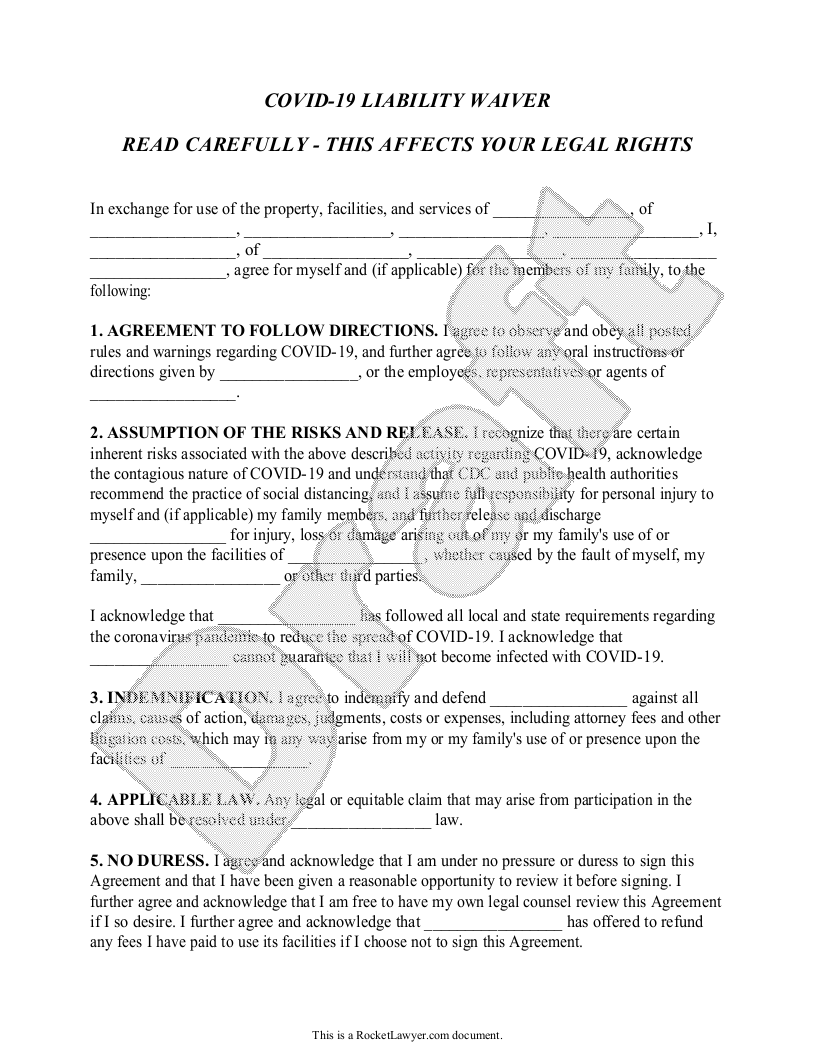

Free Covid 19 Liability Waiver Template Rocket Lawyer

Boat Waiver Form Fill Online Printable Fillable Blank Pdffiller